Although written in 2005, this article is still relevant in today's business/legislative environment.

Issue Date: March, 2005

Best Practices: Auditing Your Suppliers

Sarbanes-Oxley compliance may require your company to monitor your contingent workforce service providers

Brian Korsmeier

Publicly held companies know they must comply with the Sarbanes-Oxley

Act of 2002 by taking responsibility for the effectiveness of internal

controls over financial reporting. This means certifying an annual,

integrated audit of financial statements and internal controls.

Section 404 of the act deals in part with certifying the sufficiency

of controls for detecting fraudulent, questionable or unauthorized

activities that could impact company financial statements. It focuses on

a company's internal controls, but it also requires close scrutiny of

the internal controls of the company's service providers. In fact, not

only service providers to public companies but other service providers

they in turn rely on may fall under this regulatory authority.

The Public Company Accounting Oversight Board (PCAOB), created to

oversee Sarbanes-Oxley (SOX) compliance, has made it clear that

accountability extends to the controls of third-party service providers

whose services directly impact the internal control environment or

financial reporting of a company. Financial Executive magazine

summarized the effect of this provision in its December 2003 issue: "As

far as Section 404 is concerned, an outsourced business process is no

different from one handled internally. In other words, if it impacts

your financials, you are responsible for ensuring that the controls are

effective."

That said, if your company is subject to SOX, your responsibilities

extend to third parties involved in providing contingent workers for

you. Let's examine who is included in this category.

Which Third Parties?

Complying

with SOX requirements inevitably requires grappling with some of the

details of financial responsibilities. It involves both scrutinizing the

accounts or business processes that relate significantly to financial

reporting and looking at how third parties are being used. The former

activity sets the scope of the internal controls to be assessed. The

latter narrows the field of service providers to those whose services

are actually related to the gathering or processing of financial data.

In looking at processes and their related controls, it is useful to

take a deep breath and consider the definition given in PCAOB AU section

324. It says that internal control functions (whether outsourced or

not) include those that affect either procedures by which transactions

are initiated, recorded, processed and reported, from their occurrence

to their inclusion in the financial statements, or related accounting

records that support information and specific accounts in the company's

financial statements. Many of the processes involved in acquiring and

managing your temporary workforce may fit these criteria.

The key to your approach to meeting the compliance requirement is who

is doing the activities. If any part of the process is done for you by a

third party, even a sibling company of yours, there is a good chance

that you are responsible for confirming its internal controls. In this

context, a staffing company providing you with staff augmentation, while

certainly a candidate for periodic audits to confirm invoice accuracy

or contract compliance, probably does not fall under the "service

provider" requirements of Sarbanes-Oxley because the internal controls

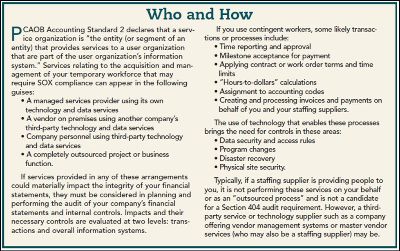

are yours, not theirs. (For details, see the sidebar "Who and How.")

You have a range of available options, used separately or in

combination, for determining compliance by the service provider. Your

company may test internal controls at the service organization. You may

obtain a report from an independent auditor that analyzes specific

controls. You may evaluate your own controls over the activities of the

service organization. You may test your controls over data/information

flow to and from the service organization. You may obtain from the

service organization an SAS 70 Type II report prepared by an independent

auditor and paid for by the service organization.

Which option to use typically is the auditor's decision and depends

on the nature and complexity of the third-party services and the level

of interaction between your company and the service provider. For

example, if your company is actively involved in creating a cost

accounting transaction from an approved time sheet, which is then passed

to your service provider to create a consolidated invoice or payment,

it is likely that only selected service provider controls must be

assessed. On the other hand, if the service provider manages the

time-sheet approval, initiates the cost accounting transaction, passes a

consolidated invoice directly to your accounts payable system and then

pays the staffing suppliers on your behalf, it is reasonable to expect a

comprehensive assessment of controls from the service organization.

What is SAS 70?

As noted

above, an SAS 70 Type II report is one way to obtain compliance. In June

2004 the Securities and Exchange Commission (SEC) recognized it as an

acceptable method for obtaining an auditor's opinion for SOX Section

404.

Created by the American Institute of Certified Public Accountants

(AICPA) in 1993, Statement on Auditing Standard 70 has received new

attention since passage of the Sarbanes-Oxley Act. It was established to

tell an independent auditor how to assess the internal controls of a

company providing services to another company and afterward how to issue

an official auditor's opinion. The standard focused on services that

could have an impact on the user organization's financial reporting,

among them payroll services, benefits and claims processing, outsourced

IT operations or data centers, and vendor management services or

software.

The SAS 70 audit's contents are flexible in that the

comprehensiveness of the controls to be reviewed is determined by the

service vendor, though within some standard categories. The resulting

auditor findings are not really "certifications" of compliance to a

standard but are the auditor's opinions regarding those controls,

presented to the service organization.

The basic Type I report presents the service organization's

description of controls at a specific point in time and offers the

auditor's opinion as to the fairness of the description and the

suitability of the design of the controls for obtaining the specified

control objectives. It does not provide an opinion regarding the

effectiveness of the operation of the controls. SOX compliance requires a

Type II report, which adds to the content of a Type I report a detailed

description of the tests of the controls over a minimum period of six

months and the auditor's opinion as to the effectiveness of the tested

controls.

In a pre-Sarbanes-Oxley era, SAS 70 reports might have been used to

satisfy a user organization's RFP or simply required by the client

company in order to do business, or the service provider could have used

them as a competitive marketing tool. In any case, if designed

properly, the reports could provide a sound analysis and the foundation

for internal improvement within the service company.

Now that Sarbanes-Oxley regulations are in place, the SAS 70 Type II

report, if developed properly, seems to satisfy a new need. The AICPA

Audit Guide - Service Organizations was amended in May 2004 to state

that "SAS 70, as amended, addresses the effect that a service

organization may have on a user organization's financial reporting

requirements."

Proceed with Caution

Merely

having an SAS 70 Type II report from a service provider, however, is not

automatically sufficient for Section 404 compliance. It must be heavily

scrutinized for the following four factors:

Timing.

Your company has unique

reporting deadlines based on its fiscal year. The time frame of the

service organization's audit activity must match your requirements for

both when the report is completed and the period being covered.

Scope.

The report must cover all

of the Sarbanes-Oxley internal control components: control environment,

risk assessment activities, control activities, information and

communication systems and monitoring activities. In addition, it should

include controls for which your company is responsible as data flows to

and from the service provider.

Content.

The report must cover

all controls that are critical to your company's financial statements,

not just those selected by the service provider. And it must include all

controls tested, not just those that tested well.

Auditor independence.

The SEC has

determined that there is no conflict if you use the same auditor as

your service provider, but that auditor cannot also provide consulting

services to the provider on how to perform the SAS 70 audit.

In short, be aware that an SAS 70 report offered by your service

provider may not satisfy your company's SOX requirements. It is, after

all, that company's report, not yours. It may be both more prudent and

more cost-effective to utilize one or more of the other acceptable

auditing methods. Your auditing team should make this decision with

management input.And remember, regardless of the method chosen, it is

still the user organization's responsibility - yours, in other words -

to assess the controls properly and potentially to invoke additional

internal controls before and after the interaction with the service

provider.

What If

Under Sarbanes-Oxley,

if your service provider cannot or will not provide an acceptable SAS 70

Type II report or permit access to your auditors, you are the one on

the hook. You and your auditors must determine the significance of not

having it; you cannot simply leave it out if it should be there. In

October 2004, the PCAOB issued additional guidance that essentially says

that the auditor must determine, and state in its report to the SEC,

whether the deficiency represents a material weakness and whether

management has failed to fulfill its responsibilities.

Such a statement can have consequences. Non-compliance potentially

can lead to legal action by the SEC. And if there are sufficient

"material weaknesses" or it becomes clear that management "has not

fulfilled its responsibilities," the investment community may react

negatively.

With temporary workforce spend rates increasing, the integrity and

effectiveness of internal controls merit scrutiny, no matter who manages

the process. If you are handling the entire process and all the

underlying technology for acquiring and managing your temporary

workforce, the internal controls are your own. If you outsource any part

of the process or enabling technology, though, you should monitor the

internal controls of the service providers as a sound business practice;

you must exercise due diligence as a Sarbanes-Oxley requirement.

Therefore it follows that understanding how a service provider

approaches and manages its internal control responsibilities should be a

key criterion in selecting those service providers and structuring the

contractual relationship.

There are volumes of rules, guidelines and standards on this topic,

and they are still changing as the Sarbanes-Oxley era matures. Given the

complexity and evolution of the statutory requirements, your company

ultimately must determine its position regarding Section 404 compliance

by relying on the experience and expertise of your auditors.

Copyright 2005 by Staffing Industry Analysts

available from the SIA website:

|